- Business Plans

-

-

- Funding & Capital ReadinessFor entrepreneurs and companies seeking financing, grants, or institutional capital.

- Startup Business Plans

- Bank & SBA Business Plans

- Investor Capital Business Plans (Private Equity)

- Grant Writing Business Plans

- Nonprofit Business Plans (501(c)(3))

- USDA Business Plans

- Request for Proposal (RFP) Response Plans

- Business Proposal

-

- Transactions, M&A & ValuationFor owners and executives preparing for exits, acquisitions, or ownership changes.

- M&A / Acquisition Business Plans

- Exit Planning & Succession Plans

- Equity & Capital Strategy Planning

- Business Valuation Reports

- Confidential Information Memorandums (CIMs)

- Reverse Merger Advisory Services

- IPO Preparation Services

-

-

-

- Operations, Compliance & Risk PlanningFor companies strengthening execution, compliance, and resilience.

- Operations Plans (SOP)

- Policy & Procedures Manuals

- Marketing Plans

- Commercial Lease & Facility Plans

- Financial Forecasting & Projections

- Business Continuity Plans

- Compliance & Regulatory Business Plans

- Cybersecurity Risk Business Plans

- Business Analytics Services

-

-

- Immigration Visas

- Pitch Materials

- Industries

- Plan

- Build

- Fund

- About

- Quote

- Net 30

- Login

- Business Plans

-

-

- Funding & Capital ReadinessFor entrepreneurs and companies seeking financing, grants, or institutional capital.

- Startup Business Plans

- Bank & SBA Business Plans

- Investor Capital Business Plans (Private Equity)

- Grant Writing Business Plans

- Nonprofit Business Plans (501(c)(3))

- USDA Business Plans

- Request for Proposal (RFP) Response Plans

- Business Proposal

-

- Transactions, M&A & ValuationFor owners and executives preparing for exits, acquisitions, or ownership changes.

- M&A / Acquisition Business Plans

- Exit Planning & Succession Plans

- Equity & Capital Strategy Planning

- Business Valuation Reports

- Confidential Information Memorandums (CIMs)

- Reverse Merger Advisory Services

- IPO Preparation Services

-

-

-

- Operations, Compliance & Risk PlanningFor companies strengthening execution, compliance, and resilience.

- Operations Plans (SOP)

- Policy & Procedures Manuals

- Marketing Plans

- Commercial Lease & Facility Plans

- Financial Forecasting & Projections

- Business Continuity Plans

- Compliance & Regulatory Business Plans

- Cybersecurity Risk Business Plans

- Business Analytics Services

-

-

- Immigration Visas

- Pitch Materials

- Industries

- Plan

- Build

- Fund

- About

- Quote

- Net 30

- Login

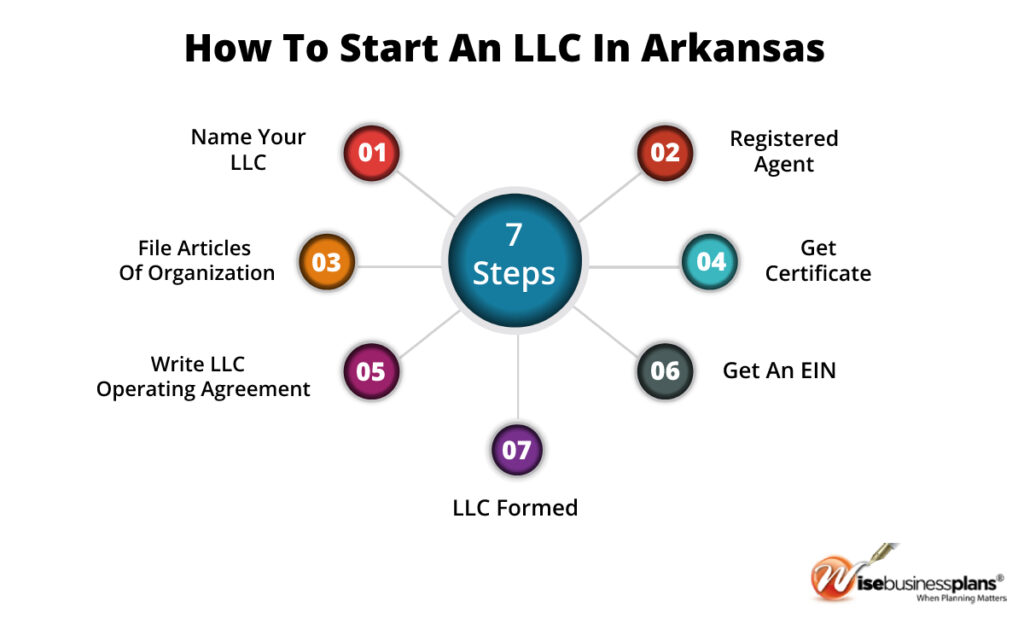

How to Start an LLC in Arkansas

Here are the 7 steps to start a limited liability company (LLC) in Arkansas

For more information on how to form an LLC in any state, see the article How to Form an LLC.

Find out how to form a Arkansas LLC for yourself

Learn about Arkansas

LLC formation, including information on Registered Agents, naming rules, business licenses, and more.

OR

Make your life easier with Wise Business Plans

Get the easiest and fastest Arkansas

LLC formation online with worry-free services and support.

See why Wise Business Plans is the best way to start an Arkansas LLC

Are you looking to create an LLC in Arkansas? You came to the right place!

AND THE BEST PART?

Our business formation services go beyond just creating your Arkansas LLC. We will handle everything from writing your business plan to creating your LLC, licensing, branding, website, and marketing.

Our Successful LLC Service Reviews

Creating an LLC in Arkansas

A limited liability company (LLC) offers many benefits to small businesses, including liability protection and tax advantages.

An Limited Liability Company LLC must be formed in Arkansas by filing a Certificate of Formation with the Arkansas Secretary of State and paying the $50 filing fee.

However, you’ll first need to choose a name and registered agent for your Arkansas LLC.

Arkansas LLC filings are usually processed within 2-3 business days for online filings and within two weeks for mailed filings. There is also an option for expedited processing.

An LLC can be easily formed in Arkansas. Our step-by-step guide on How to Start an LLC in Arkansas will help you get started today. Find out more about LLCs and their benefits in our What is an LLC guide.

Step 1. Choose a Name for Your LLC Arkansas

Creating an LLC in Arkansas requires you to choose a business name before you can file a Certificate of Formation. Be sure that your business name complies with the Arkansas naming requirements and can be searched by potential customers.

- Arkansaslaw requires an LLC name to contain the words “Limited Liability Company” or “Limited Company,” or the abbreviations “Ltd.,” “LLC,” or “LC.” “Limited” may be abbreviated as “Ltd.” or “LTD,” and “Company” as “Co.”

- It is not acceptable for your ArkansasLLC to have words associated with a government agency (FBI, Treasury, State Department, etc.).

- You should avoid using words or abbreviations that may make your LLC Arkansasappear to be a different type of entity, such as “LP” or “corporation”.

- There may be additional documentation and licensure paperwork required for certain restricted words (bank, lawyer, attorney, credit union, etc.).

- Check the state’s business name database to ensure the name you want is not already taken(including businesses no longer in operation)

See a complete list of Arkansas’ naming rules here.

Check URL availability: You are likely to need a web page even if you don’t think you do. Buying your domain name now will at least give you the option of having one in the future. It’s a good idea to check the URL availability before finalizing your Arkansas LLC name.

You can submit an Application for Reservation of Entity Name to the Arkansas Secretary of State. Once your application has been processed, you will have 120 days to use the name before it expires. LLCs may renew their reservation once.

Application for Reservation of Limited Liability Company Name RN-06 $22.50.

An LLC stands for a Limited Liability Company. A simple business structure that is more flexible and offers many of the same benefits as a traditional corporation. For more information, see “What is a Limited Liability Company?”.

A business name is the name given to a company. Arkansas law restricts the use of another entity’s legal name unless it has filed a certificate registering that name, commonly known as a “doing business as” or DBA name, according to state regulations.

Step 2: Appoint Your Registered Agent in Arkansas

Your next step in forming an LLC in Arkansas is to appoint a Registered Agent, an individual or company authorized to receive legal and state mail on your behalf.

All Arkansas LLCs must have a registered agent. Please include your registered agent’s name and address on your Certificate of Formation.

Registered Agent Requirements in Arkansas

To comply with Arkansas law, your LLC’s registered agent must be a resident or business entity that maintains a physical address in Arkansas. The “registered address” cannot be a P.O. box. It must be a real physical address that can be visited in person.

Further, in Arkansas, your registered agent must agree to perform this role and sign a form confirming their consent. Consent statements should include the following:

- Written confirmation that the person designated consents to serve as the LLC’s registered agent

- The name of your Arkansas LLC and the person designated as your registered agent

- Registered agent’s signature

- Date of execution

Although you do not have to submit this form to the Secretary of State, your business must record it. Learn more about Arkansas Registered Agents by reading our full guide.

Anyone over 18 with a street address in Arkansas can be the registered agent for a business in Arkansas. You may also elect a member of your LLC, or even a friend whom you trust, as long as they meet these requirements as well.

You can change your registered agent by amending your articles of incorporation or organization, but there is a filing fee for amendments, so this would only make sense if you were already filing an amendment for another reason.

Are You looking for a Registered Agent?

Wise Business Plans offers a free year of registered agent service when forming an LLC in Arkansas.

Step 3.Prepare and File Certificate of Formation

To create a Arkansas LLC, you will need to file (Form LL-01) Articles of Organization with the Arkansas Division of Corporations. You may apply online, by mail, or in person.

There is a $50 filing fee or $50 if done with paper copies. You must send the original and a copy of your certificate if you file by mail.

You will receive a duplicate form back from the state once it receives your documents.

It may take up to 14 business days to process a mailed submission.

If you choose one of our business formation services plans, we can handle this step for you.

The following information is typically required to create a Certificate of Formation:

- Your LLC name and principal place of business.

- Name, address, and signature of the LLC’s registered agent

- Decide whether your Arkansas LLC will be member-managed or manager-managed. Indicate the names and addresses of each member and manager.

- The reason for forming the LLC in Arkansas.

- Name and address of the LLC’s organizer.

- The effective date of the certificate,

- The person forming the LLC must sign the Certificate.

Foreign LLCs: LLCs that are based in another state but intend to conduct business in Arkansas must complete a form called the Qualification of Foreign LLC.

A filing fee of $270 via online. also applies to this form, and you need to attach your state’s certificate of good standing.

Two Ways to File the Certificate of Formation

The 1st option is:

Online filing through the Arkansas SOS Corporations Online Filing System

The 2nd option is:

Filing the Certificate of Formation by Mail

Address to Mail

There is a state filing fee of $50 payable to the Arkansas Department of State. (nonrefundable)

Arkansas Secretary of State

1401 W. Capital Ave.

Suite 250

Little Rock, AR 72201

In a member-managed LLC, the members (owners) take on the business’s daily responsibilities. Manager-managed LLCs are managed by managers who are elected by the members. Those who manage your LLC will have the authority to do a wide range of tasks-from hiring staff to opening bank accounts.

A domestic LLC is a company formed as an LLC in Arkansas. A foreign LLC is one with a physical presence in a different state.

It generally takes 2-3 business days to process online LLC documents and up to 2 weeks for mailed filings in Arkansas. Expedited processing may be obtained for a cost.

Step 4. Get a Certificate From the State

Upon filing your Certificate of Formation, the secretary of state will review it. As soon as the Certificate of Formation is approved, the LLC becomes a legal entity.

By obtaining this certificate, LLCs will be able to obtain an Employer Identification Number (EIN), licenses, and business accounts.

Step 5. Write an Arkansas LLC Operating Agreement

An operating agreement is a legally-binding document that sets out how your LLC will operate, from the voting process to mergers.

Operating agreements are not required in Arkansas, but they are an essential part of your business.

Written operating agreements are helpful for different reasons, including resolving disputes over financial agreements and other potential litigation.

The LLC declaration can prove that your LLC is a separate entity, which can help preserve your limited liability.

An operating agreement ensures that all business owners are on the same page and reduces the possibility of future conflict.

How should an operating agreement be drafted?

The operating agreement should detail the LLC’s overall business purpose and other important matters, such as how the company will be taxed and how new members will be accepted. Legal agreements can clarify several important concerns, such as:

- Who makes decisions for the company, especially those who decide if partners disagree.

- Who is responsible for different aspects of the business as well as for strategic decisions.

- If a partner leaves the company, what will happen to their ownership interests in the corporation.

- The members and their contributions

- How profits and losses will be divided

- Procedures for admitting new members and removing outgoing members

In Arkansas, you can include just about anything in your operating agreement, as long as it doesn’t violate the state law or the Certificate of Formation.

This is something that you must be aware of, since it is the leading reason your single-member LLC needs an operating agreement. Even if an operating agreement isn’t required in your state, running a business without one may put your LLC status at risk.

In Arkansas, an LLC operating agreement is not required, but it is strongly recommended. This is a company’s internal document that lays out the specifics of how your firm will be run. It defines the members’ and managers’ rights and duties, as well as how the business will be managed.

Step 6. Get an EIN for Your Arkansas LLC

Basically, an employer identification number (EIN) is a social security number for your LLC in Arkansas.

To identify your LLC for tax purposes, the Internal Revenue Service assigns a nine-digit Employer Identification Number (EIN). You can apply for your EIN either by mail or online.

An EIN is used for the following purposes:

- Manage state and federal taxes

- Create a business bank account

- Hire employees

Get an EIN Number in Arkansas

Getting an EIN number is easy and free, There are two ways to get an EIN number in Arkansas.

The 1st option is:

Apply online for an EIN from the IRS

The 2nd option is:

Get an EIN by Mail or Fax

Address to Mail

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

LLCs must have an EIN if they will hire people. In general, to establish a business bank account, most banks demand an EIN. The state tax identification number is referred to as a tax ID number in Arkansas. Arkansas does not require taxpayers to obtain a tax ID number from the state.

A tax classification will be discussed with you when you obtain an EIN. In most cases, LLCs choose the default status.

Some LLCs can reduce their federal tax obligation by electing S corporation status. Consult with a local accountant to find out which option is best for you.

Step 7. Pay Your Annual State Tax Obligations

The minimum tax for Arkansas LLCs and foreign LLCs is $150 per year. The Arkansas Secretary of State requires annual franchise tax reports. You may submit the annual franchise tax report online or download a form from the Arkansas Secretary of State’s website to file it. Each year by May 1, you must file an annual franchise tax report with the Arkansas.

Avoid Automatic Dissolution: If they fail to file one or more state forms, LLCs may be fined or even dissolved. In this case, LLC owners risk losing their limited liability protection. Registered agent services can help prevent this from happening by notifying you when filing deadlines approach and by submitting reports on your behalf.

Due Date:The payment of this tax is due by May 1 of the following year.

Late filing: Fee is $25 plus an interest calculation on the form.

Are you Looking for Arkansas LLC Formation Service?

Get the easiest and fastest Arkansas LLC formation online with Wise business Plans.

What to do After Forming Your Arkansas LLC

Keep your personal and business assets separate

Your personal assets (such as your home, car, and other valuables) may be at risk when your Arkansas LLC is sued if they are mixed with your business accounts.

Here are some steps you can take to protect your LLC in Arkansas:

1. Create a Business Plan:

If you decide that a Arkansas LLC will be a good choice for your business in Arkansas, your next step is to create a business plan (although it is not required), so that you have a roadmap for what you will do and how you will accomplish it.

Free: Business Plans Examples

Do you need help creating a business plan? Check out these six free, proven business plan examples from different industries to help you write your own.

2. Open a Bank Account

As soon as your LLC is officially formed, you should open a business bank account. Why? Keeping separate bank accounts will help you maintain the legal distinction between the LLC and you (the owner).

Because LLCs are limited liability companies, creditors and litigants can’t take your assets.

It is essential for small business owners to partner with the right bank. Find out which banks offer the best business checking accounts, have low or no fees, ATM accessibility, and interest-earning accounts as well as online or mobile banking tools.

Recommended: Check out our business bank account page to learn which banks offer the best business check accounts, ATM access, interest-bearing accounts, and online and mobile banking options for businesses.

3. Obtaining a business credit card:

- Allows you to separate personal and business expenses.

- Develops your company’s credit history, which can be helpful to raise capital (e.g., small business loans) later.

4. Hiring a business accountant:

- It prevents your business from overpaying taxes while preventing penalties, fines, and other costly tax mistakes.

- Gives you more time to focus on your growing business by simplifying bookkeeping and payroll.

- Manage your business’s funding more effectively. Find out where extra profit or loss can be made

Getting Business Insurance for Your LLC

You can manage risks and grow your LLC with business insurance. Here are the most common types:

- General liability insurance protects your business from lawsuits. Most small businesses purchase general liability coverage.

- Professional liability insurance protects professionals and businesses from claims of negligence from their clients or customers. Liability insurance typically covers negligence, copyright infringement, personal injury, and more.

- Workers’ compensation insurance: Covers illnesses, injuries, and deaths resulting from a worker’s work.

Ready to Protect Your Business

Let us help you with your business insurance needs.

- General business liability insurance

- Medical insurance

- Term life insurance

- Workers’ Comp

- Surety bonds

- Commercial auto

Create Your Business Website

A website is an important step in legitimizing your business. It is essential for all businesses. You are missing out on a large percentage of potential customers and revenue if you don’t have a website, even if your business is too small or in an offline industry.

More than 90% of consumers begin their search for products and services online. If you don’t have a website that is ready to welcome your customers, then they will simply find your competitors.

Here are the main reasons why you shouldn’t delay building your website:

- Every respectable firm has a website. When it comes to getting your firm online, size or sector isn’t a concern.

- Creating a basic website has never been easier, thanks to website builder tools like the GoDaddy Website Builder. To design a website, you don’t need to hire a web designer or developer.

Recommended: If you want to enhance your conversion rates and maximize revenue in order to help expand your business and meet objectives, you should always hire a professional business website design company to build your business website.

Wise Business Plans is a leading web design company, We have created over 2000 + websites across 20 countries for our clients but we are physically based in 7 major cities in the United States including Alabama web design, Pennsylvania, Las Vegas, Colorado Springs, Iowa, Michigan and San Diego.

Arkansas LLC FAQs

To file the Articles of Organization online, the Arkansas Secretary of State charges a fee of $45 and to file by mail, a fee of $50. You can reserve your LLC name with the Arkansas SOS for $25 if you file by mail, or $22.50 if you file online.

LLCs in Arkansas must also pay a minimum $150 annual franchise tax to the state.

It takes 2-3 business days to complete online LLC paperwork in Arkansas and 2 weeks for mailed filings. For an additional fee, expedited processing may be requested.

By mail or in person, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) to dissolve your Arkansas LLC. You cannot file articles of dissolution through our website. Make checks payable to “Arkansas Secretary of State.”

You must file a Certificate of Amendment with the Arkansas Secretary of State to change your Articles of Organization for an Arkansas LLC. You must also pay a $25 (paper) OR $22.50 (online) filing fee in order to submit an amendment form. This page offers instructions on how to fill out and submit the Arkansas Certificate of Amendment yourself,