How Do I Choose A Business Structure?

Table of Contents

- Choosing a Business Structure

- Formal Business Structure

- Limited Liability Company (LLC)

- Corporations

- Informal Business Structure

- Sole Proprietorship

- Partnerships

- Factors to Consider When Choosing a Business Structure

- Flexibility

- Complexity

- Liability

- Taxes

- Control

- Capital investment

- Permits, licenses, and regulations

- FAQs:

When starting a business, you must decide what form of business entity to establish. It is your business structure that determines how much tax you pay, your ability to raise money, the paperwork you need to file, and your personal liability.

Before registering your business with the state, you’ll need to choose a business structure. The majority of businesses will also have to get a tax ID number and obtain licenses and permits.

Make your choice carefully. There may be restrictions related to your location if you decide to switch to a different business structure at a later date. Consulting an attorney, accountant, or business counselor may be a good idea.

Different kinds of business structures are sole proprietorship, partnership, Limited Liability Company (LLC), and Corporations. The S Corporation is a form of tax reputation decided on with the aid of using a company or LLC.

Choosing a Business Structure

In choosing a business structure, it is important to identify if you need liability protection.

What is personal liability protection? Liability protection can create a legal separation between your assets and your business.

Formal Business Structure- Since the business is legally separated from its owner, formal business structures such as LLCs and corporations offer liability protection.

InFormal Business Structure- Sole proprietorships and partnerships do not offer protection since there is no separation between the business owner and the business. In a nutshell, the owners’ assets are exposed to creditors and lawsuits.

Formal Business Structure

Creating formal business structures offers tax benefits, increased credibility, and most importantly, protection from personal liability.

Formal business structures fall into two main categories:

Limited Liability Company (LLC)

In a limited liability company (LLC), owners, partners, or shareholders can limit their personal liability while enjoying tax and flexibility benefits normally associated with partnerships. In an LLC, members are shielded from personal liability if they do not act in an illegal, unethical, or irresponsible manner in carrying out the business’s activities.

Business owners can enjoy limited liability company protection while earnings and losings are subject to personal taxation, LLCs can have one or more members, and profits and losses are not evenly divided among them.

The LLC is a good option for those who have a high-risk business, need to protect significant personal assets, or want a lower tax rate than a corporation.

Corporations

Corporations are legal entities created to conduct business. As a separate entity from those who founded it, the corporation handles the organization’s responsibilities. The corporation is liable for its actions and can be taxed like a person. It can also make a profit. Corporations are exempt from personal liability.

Forming a corporation is expensive, and extensive record-keeping is necessary. Incorporation is sometimes criticized for its double taxation, but the S corporation (or Subchapter corporation, another variation of the regular C corporation) avoids this problem by allowing income and losses to be passed through to individual tax returns.

Informal Business Structure

Formal business structures do not offer tax benefits or liability protection. Informal business structures fall into two main categories:

Sole Proprietorship

The simplest type of business entity. In a sole proprietorship, all profits and debts belong to one person. As a sole proprietor, you can operate your business from home without a physical storefront, but this entity does not provide separation or protection of personal and professional assets, which will cause problems as your business grows and more aspects hold you responsible.

Nevertheless, sole proprietors are still able to register a trading name. In addition, it can be difficult to raise money because you cannot sell a stock, and banks are hesitant to lend to sole proprietorships.

A sole proprietorship is a good option for low-risk businesses and owners who want to test their business idea before forming a more formal firm.

Partnerships

It is the simplest business structure for two or more people to own together. A limited partnership (LP) and a limited liability partnership (LLP) are two kinds of partnerships.

In a limited partnership, only one general partner has unlimited liability, while all other partners have limited liability. As a partner with limited liability, you have fewer control over the business, which is documented in your partnership agreement.

The profits of general partners – the partners without limited liability – are passed through to their tax returns, and they have to file self-employment taxes. A limited liability partnership is similar to a limited partnership, but it limits the liability of each owner. It protects each partner from debts against the partnership, so they won’t be held liable for their partners’ actions.

Businesses with multiple owners, professional groups (such as law firms), or groups who wish to test their business ideas before forming a more formal company can find partnerships an attractive choice

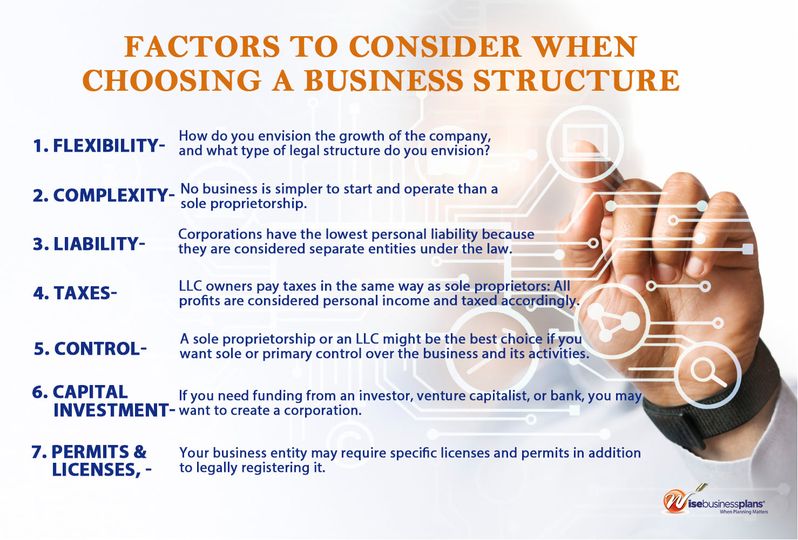

Factors to Consider When Choosing a Business Structure

Choosing the right structure isn’t always easy. Consider your startup’s financial needs, risk, and ability to grow. Switching your legal structure once your business has been registered can be challenging, so make sure you do a thorough analysis early on in the process.

Here are some important factors to consider when choosing your business’s legal structure. You should also consult with your Business Attorney.

Flexibility

How do you envision the growth of the company, and what type of legal structure do you envision? Review your business plan to see which structure aligns with your goals. Growing and changing entities should be supported, not hindered.

Complexity

No business is simpler to start and operate than a sole proprietorship. You register your business name, start doing business, report your profits, and pay taxes on them as personal income.

Financing, however, can be tricky. In contrast, a partnership requires an agreement to define the roles and the share of profits. Corporations and limited liability companies are required to report to state governments and to the federal government.

Liability

Corporations have the lowest personal liability because they are considered separate entities under the law. It means creditors and customers may sue the company, but they cannot obtain access to the assets of its officers or shareholders.

Forming an LLC provides the same protection, but with the tax benefits of a sole proprietorship. With a partnership, the liability is split between its partners based on the agreement.

Taxes

LLC owners pay taxes in the same way as sole proprietors: All profits are considered personal income and taxed accordingly. The LLC structure prevents double taxation in the early stages, so you are not taxed as a company but as an individual.

Profits from a partnership are also claimed as personal income by partners. To minimize your tax impact, your accountant may recommend quarterly or biannual advance payments.

Each year, a corporation submits its own tax returns, paying taxes on profits after expenses, including payroll. You will owe personal taxes, such as Social Security and Medicare, when you receive wages from the corporation.

Control

A sole proprietorship or an LLC might be the best choice if you want sole or primary control over the business and its activities. This can also be negotiated in a partnership agreement.

In a corporation, a board of directors makes major decisions that guide the company.

Corporations are usually controlled by one person at their inception, but as they grow, they become governed by boards. Even small corporations must follow rules that are intended for larger organizations – like keeping track of every major decision that affects them.

Capital investment

If you need funding from an investor, venture capitalist, or bank, you may want to create a corporation. The process of obtaining external funding is easier for corporations than for sole proprietorships.

A corporation can sell shares of stock to raise money for growth, while a sole proprietor can only obtain funds through a personal account, using their own credit or partnering. LLCs can also face challenges, although, since it is their own entity, its owner may not have to use their own assets or credit.

Permits, licenses, and regulations

Your business entity may require specific licenses and permits in addition to legally registering it. It may be necessary to obtain a local, state, and federal license based on the type of business and its activities.

According to the State, business structures vary according to where you set up, and varying requirements also apply at the municipal level. Understanding your industry and state will help you choose your structure.

The structures discussed here only apply to for-profit businesses. If you’ve done your research and you’re still unsure which business structure is right for you, Consult the business attorney.

FAQs:

When choosing a business structure, consider factors such as liability protection, tax implications, ease of formation and management, and the desired level of ownership and control. Assess your specific business needs and goals to determine the most suitable structure.

The main types of business structures include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its own advantages and disadvantages in terms of liability, taxation, and governance. It’s important to understand the characteristics of each structure before making a decision.

Sole proprietorships and partnerships offer little to no liability protection, meaning the owner’s personal assets are at risk. LLCs and corporations, on the other hand, provide limited liability protection, shielding the owners’ personal assets from business liabilities.

Sole proprietorships, partnerships, and LLCs generally have pass-through taxation, where business profits and losses are reported on the owners’ personal tax returns. Corporations, however, are subject to double taxation, as both the corporation’s income and the owners’ dividends are taxed.

It is advisable to consult with a qualified professional, such as an attorney or accountant, who can provide personalized guidance based on your specific circumstances. They can help you understand the legal and financial implications of each structure and assist in making an informed decision.