Types of Business Structures

Table of Contents

We don’t always see a path forward as clearly as we would like to. But charting our way with some sort of business road map can help us to see the way more clearly and can often give us the courage that we need to take those first steps.

This map is known as a business plan. The business plan and its structure will have legal and tax implications. The following might help you identify the different types of business structures and find the one best suited for your business.

Regardless of the business structure that you choose, having a basic understanding of the types of businesses most commonly formed can help you when it is time to answer questions from your business plan developer or you just need to see a clear path ahead.

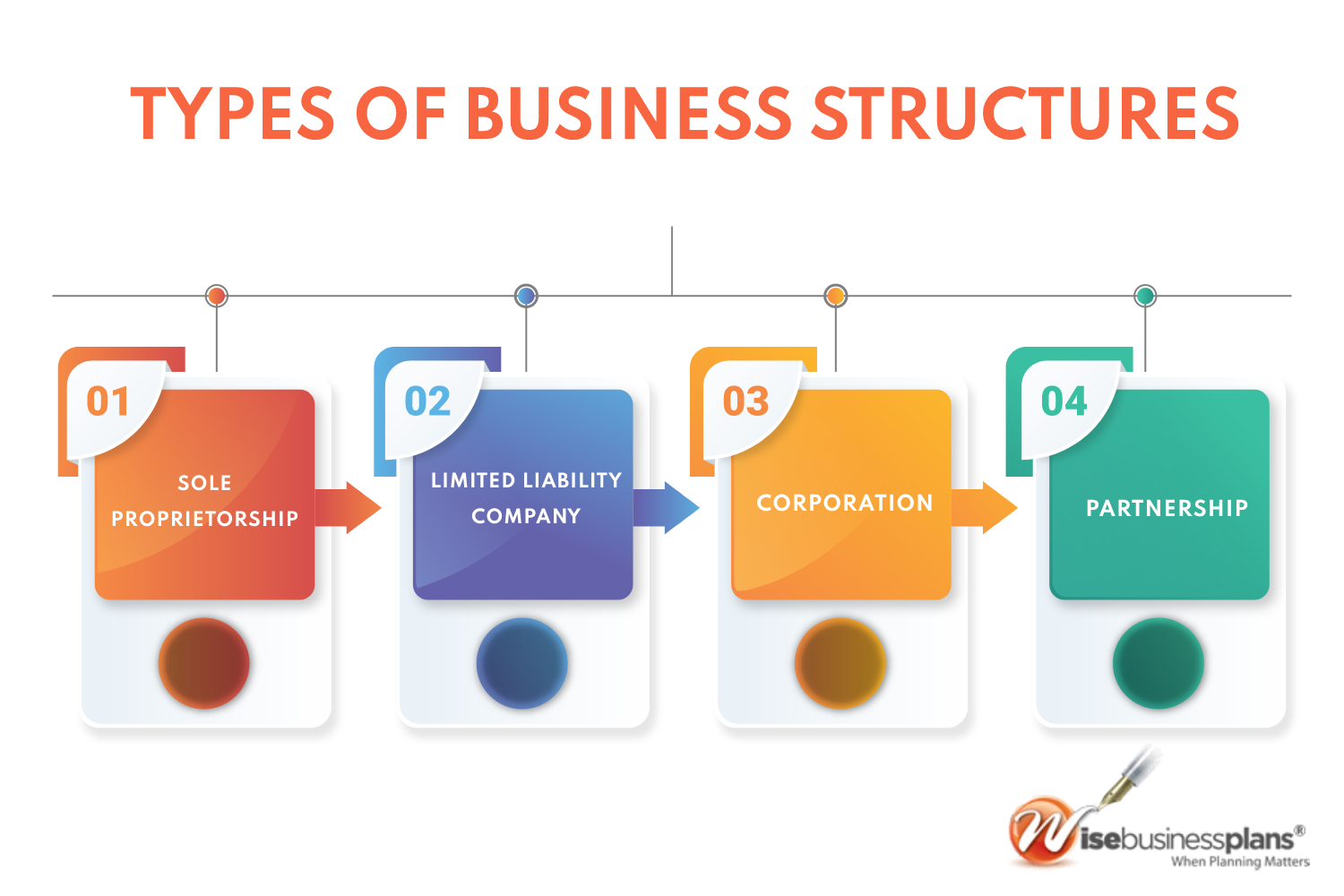

Types of Business Structures

A business structure is the legal structure of an organization recognized in a particular jurisdiction. The legal structure of an organization determines the activities that it can engage in, such as raising capital, fulfilling obligations owed to the organization, and paying taxes.

Business owners should examine their business goals and needs and understand the advantages and disadvantages of each legal structure before making a decision. There are four main types of business structures:

- Sole Proprietorship

- Limited Liability Company

- Partnership

- Corporation

1. Sole Proprietorship

A Sole Proprietorship is the most basic type of business to establish. Sole proprietorships are easy to form, and they provide complete control of your business. You alone own the company and are responsible for its assets and liabilities. It is an unincorporated business owned and run by one individual with no distinction between the business and the owner. You are entitled to all profits and are responsible for all your business’s debts, losses, and liabilities.

There are several benefits to choosing a sole proprietorship business structure. To begin with, it is inexpensive to start, and there are minimal fees associated with registering a sole proprietorship.

2. Limited Liability Company

An LLC combines the advantages of both corporation and partnership business structures. A Limited Liability Company (LLC) is designed to provide the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership.

All profits and losses are “passed through” the business to each member of the LLC. Furthermore, unlike an S-corporation, which has a shareholder limit of 100, there is no limit on the number of shareholders in a limited liability company.

In order to form an LLC, the entity must file its articles of association with the Secretary of State where it intends to do business.

3. Corporation

A corporation is an independent legal entity owned by shareholders. This means that the corporation itself, not the shareholders that own it, is held legally liable for the actions and debts the business incurs. Corporations offer the strongest protection from personal liability for their owners, but the formation costs are higher than for other structures. A corporation must also maintain extensive records, enhance its operational processes, and provide more detailed reporting.

Corporations pay income tax on their profits, unlike sole proprietors, partnerships, and LLCs. In some cases, corporate profits are taxed twice: once when the company makes a profit and once when dividends are paid to shareholders on their personal tax returns.

Corporations are independent of their shareholders and have a completely separate life. Here are some of the different types of corporations:

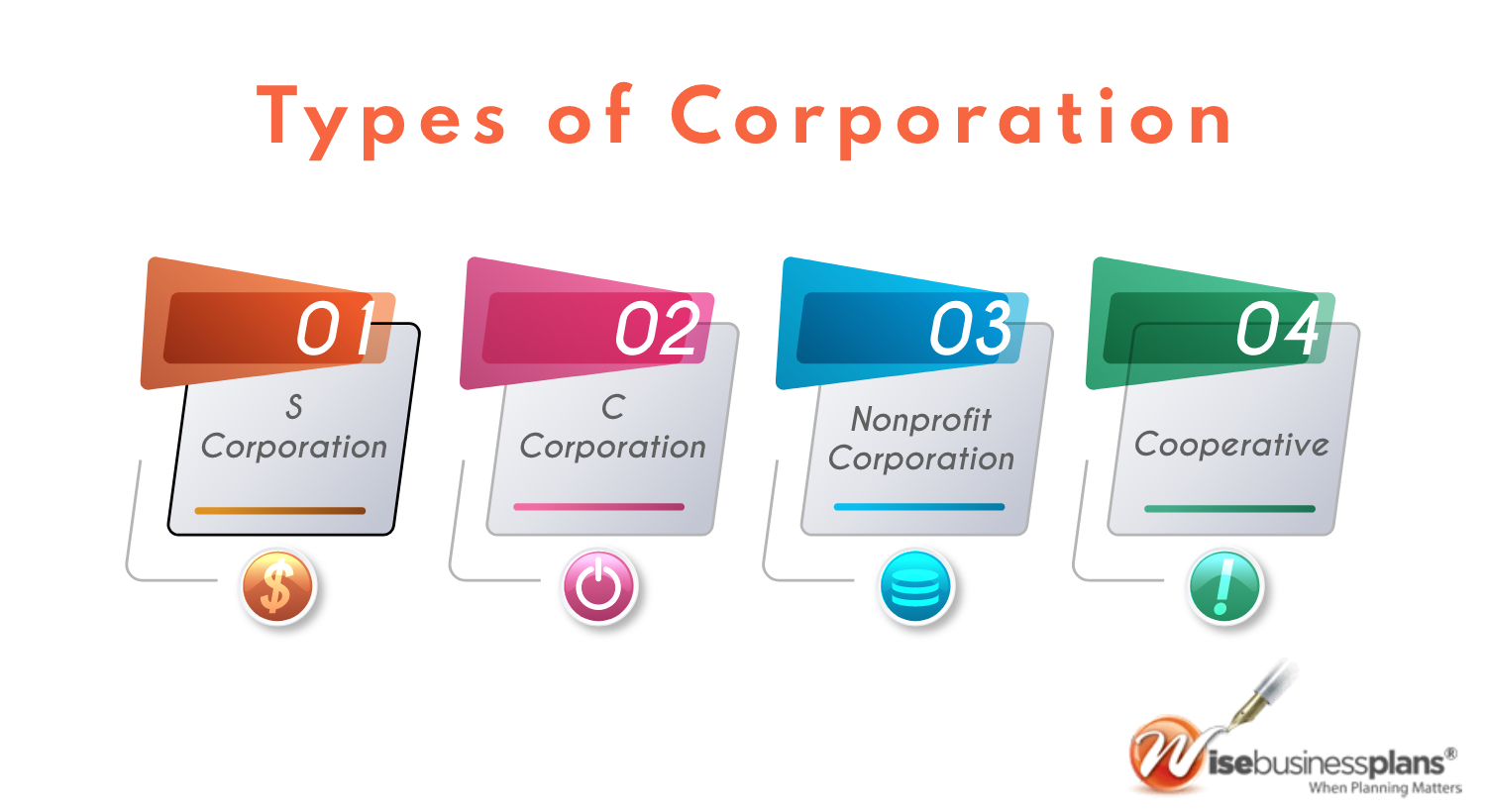

Types of Corporation

- S corporation- The S corporation, also known as the S corp, is a special type of corporation designed to avoid the disadvantage of double taxation of regular C corporations.

- C corporation- C corporations are legal structures in which the owners, or shareholders, pay separate taxes to the entity and the owners. The most prevalent type of corporation, the C corporation, is subject to corporate income tax as well.

- Nonprofit Corporation- A nonprofit corporation is formed to provide charity, education, religious, literary, or scientific activities. Usually, nonprofits receive tax-exempt status since their work benefits the public, so any profits they make are not subject to state or federal income taxes.

- Cooperative- A cooperative is a business or organization owned by and operated for the benefit of those using its services. Profits and earnings generated by the cooperative are distributed among the members, also known as user-owners. Typically, a cooperative is run by a board of directors and officers who are elected by its members. Regular members vote to control the direction of the cooperative.

4. Partnership

In the business world, a partnership is when two or more people own the business. A partnership is the most straightforward form of business structure for two or more owners. Each partner contributes to all aspects of the business, including money, property, labor, or skill. In return, each partner shares in the profits and losses of the business. There are two types of partnerships: limited partnerships (LP) and limited liability partnerships (LLP).

Types Of Partnerships

- Limited Partnership- In limited partnerships, there is only one general partner who carries unlimited liability and all other partners carry limited liability. A partnership agreement documents that the limited-liability partners also have limited control over the company.

- Limited Liability Partnership- Partnerships with limited liability are similar to limited partnerships, but their owners are limited in their liability. In an LLP, each partner is protected from debts incurred by the partnership. They will not be responsible for the actions of the other partners.

Need to Register Your Business Entity?

Our business formation services let you incorporate a company in a simple, straightforward manner that makes the process easy and lets you focus on other important matters

FAQs:

A sole proprietorship is a type of business structure where an individual owns and operates the business. It offers simplicity, full control, and direct tax implications, but the owner is personally liable for any business debts or liabilities.

A partnership is a business structure where two or more individuals share ownership and responsibility for running the business. Partnerships can be general partnerships, where all partners share equal liability, or limited partnerships, where there are both general and limited partners with varying degrees of liability and involvement.

A corporation is a legal entity separate from its owners, known as shareholders. It offers limited liability protection, continuity of existence, and the ability to raise capital through the issuance of stocks. Corporations are subject to more regulations and formalities compared to other business structures.

An LLC is a hybrid business structure that combines the limited liability protection of a corporation with the flexibility and pass-through taxation of a partnership. It offers personal asset protection, simplified management, and flexibility in profit distribution among members.

A cooperative is a business structure owned and operated by a group of individuals or businesses with shared goals. Members contribute to and benefit from the cooperative, which can be formed to provide goods, services, or resources. Co-ops prioritize democratic decision-making and equitable distribution of benefits among members.