Pros and Cons of SBA Loans

Small businesses are the backbone of the US economy, and funding is crucial for their success. The Small Business Administration (SBA) provides a variety of loan programs to help entrepreneurs start and grow their businesses.

SBA loans offer several advantages over traditional bank loans, including longer repayment terms, lower down payments, and no early balloon payments.

However, they also come with some downsides, such as high credit standards, collateral requirements, and personal guarantees. As a small business owner, it’s important to weigh the pros and cons of SBA loans before applying for one.

In this article, we will explore the benefits and drawbacks of SBA loans, giving you a comprehensive understanding of what to expect when considering this financing option.

Whether you’re just starting your business or looking to expand, this guide will help you make an informed decision about SBA loans.

Success rates:

It’s important for small business owners to have a realistic understanding of their chances of getting approved for an SBA loan. According to Balboa Capital In 2020, the SBA approved 61.9% of loan applications for the SBA program.

While this is a relatively high approval rate, it’s important to note that the application process can be lengthy and requires a strong credit score and financial history.

By understanding the success rates and requirements for SBA loans, businesses can better prepare their loan applications and increase their chances of success.

More For You: Discover how to create an effective Business Plan for SBA Loan to secure financing for your venture.

Benefits of an SBA Loan:

Here are nine benefits of an SBA Guaranteed Loan:

- Longer Terms: One of the main advantages of SBA loans is that they come with longer repayment terms compared to traditional bank loans. For instance, SBA loans for real estate can have a term of up to 25 years, whereas conventional loans typically have a maximum 15-year term. This longer repayment period can help to ease cash flow issues during slow periods.

- Lower Down Payment: SBA loans usually require a down payment of no more than 20% of the entire project cost, which is lower than the down payment required for conventional loans. This can greatly lower your out-of-pocket expenses and increase your rate of return on investment. Additionally, SBA loans often finance the loan soft costs, such as appraisal, title, and processing fees, which conventional loans may not cover.

- No Early Balloon Payment: SBA-guaranteed loans are fully-amortizing, which means that you will not face the stress and costs of refinancing your loan every few years. There are no early balloon payments or payable on demand clauses, unlike most conventional loans.

- No Prepayment Penalty: If the term of your SBA loan is less than 15 years, there is no prepayment penalty. If the term is 15 years or more, a 3-year prepay penalty applies only if you prepay more than 25% of the loan in any one year or if you pay off the entire loan early. The prepayment penalty is calculated on the excess amount and is 5% in the first year, 3% in the second year, and 1% in the third year.

- No Ongoing Debt Service Requirements: Usually, there will be no minimum requirement to keep a ratio of your monthly debt payment to the income stream that your business brings in, which is typically a mandatory requirement of traditional bank financing.

- One-Time Close for Construction Loans: If your plans call for construction, an SBA loan can provide a one-time close. With no second closing, you begin the repayment schedule after construction is completed, and you only have to sign one set of documents and work with only one lender. This saves you money on closing costs and streamlines the process.

- Working with a Preferred Lender Streamlines the Process: Under the SBA’s Preferred Lender Program (PLP), the SBA has authorized the PLP designated lender to make lending decisions on their behalf. Loan proposals do not need to go to the SBA for approval, which means the process moves more quickly and can usually close at the same time it takes a typical conventional commercial loan to close.

- Available Property Types to Finance are More Numerous: The property being purchased must be for business use and can be an Industrial or Commercial Building, a Retail Shop, Office Condominium, or even a single-purpose property (such as a Gas Station, Car Wash, Motel, Restaurant, etc.). The business must occupy at least 51% of the property being purchased.

- SBA-Guaranteed Loans are Assumable: SBA loans are assumable with a relatively simple application subject to approval and a small fee.

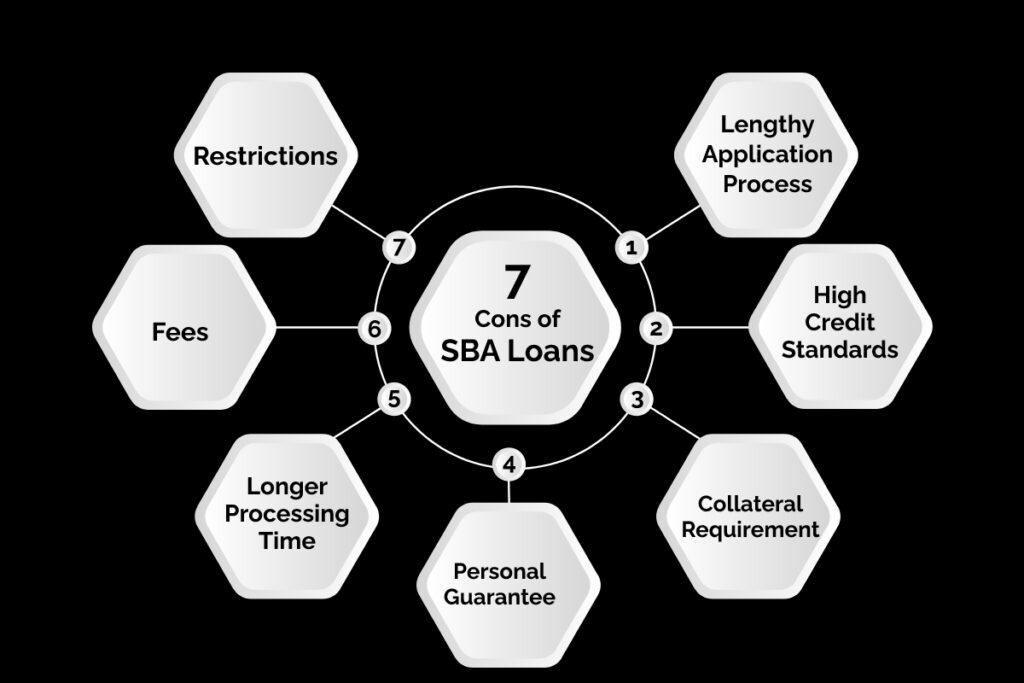

Cons of SBA Loans:

- Lengthy Application Process: The application process for SBA loans can be lengthy, with multiple forms and documents required. The process can take several weeks to several months to complete, which may not be ideal for businesses.

High Credit Standards: SBA loans require a high credit score and a strong financial history. This can make it difficult for some small business owners to qualify for the loans.

Collateral Requirement: SBA loans often require collateral to secure the loan. This can be challenging for small business owners who may not have sufficient collateral.

Personal Guarantee: SBA loans often require a personal guarantee from the business owner. This means that if the business is unable to repay the loan, the owner is personally responsible for the debt.

Longer Processing Time: SBA loans can take longer to process and approve compared to traditional bank loans. This can be a challenge for small businesses that need financing quickly.

Fees: SBA loans come with fees, including a guarantee fee that can be up to 3.5% of the loan amount. These fees can add up and increase the cost of borrowing.

Restrictions: SBA loans come with restrictions on how the funds can be used. For instance, the loan cannot be used for investment properties or to refinance debt.

Tips for Applying for an SBA Loan:

If you’re considering applying for an SBA loan, here are some tips to help improve your chances of success:

- Check your credit score: SBA loans require a high credit score, so it’s important to check your credit score before applying. If your score is low, take steps to improve it before applying.

- Prepare a strong loan application: To increase your chances of approval, prepare a strong loan application that includes a detailed SBA business plan, financial projections, and other relevant information.

- Gather all required documents: SBA loans require several documents, including tax returns, financial statements, and business licenses. Make sure you have all the required documents ready before applying.

Seek help from a financial advisor: Working with a financial advisor can help you navigate the loan process and ensure that you’re making informed decisions.

Alternative financing options:

While SBA loans are a popular financing option for small businesses, they are not the only option. There are several alternative financing options to consider, such as traditional bank loans, crowdfunding, and angel investors.

Traditional bank loans are a good option for businesses with strong credit and a history of profitability. Crowdfunding allows businesses to raise money from a large number of individuals, often in exchange for a product or service.

Angel investors are individuals who invest their own money in startups in exchange for equity in the company. By understanding the various financing options available, businesses can make an informed decision about which option is best for them.

Conclusion:

SBA loans can be a great source of financing for small business owners, offering longer terms, lower down payments, no early balloon payment, no prepayment penalty, and other advantages.

However, they also come with some downsides, including high credit standards, collateral requirements, personal guarantees, longer processing times, fees, and restrictions.

As a small business owner, it’s important to carefully consider the pros and cons of SBA loans before applying for one. You should also consult with a financial advisor to determine if an SBA loan is the best financing option for your business.