Credit Union 1 Routing Number

Having trouble in tracing your Credit Union 1 Routing Number while sending or receiving wire transfers to or from other States and countries? To avoid canceled payments and delayed transfers, always use the correct routing number.

Credit Union 1 Routing Numbers for Fund Transfers:

The Credit Union 1 Routing Number for domestic and international fund transfers is 325272063.

| Type of Fund Transfer | CU1 Routing Number |

|---|---|

| Domestic Fund Transfer | 325272063 |

| International Fund Transfer to Credit Union 1 Account in the USA | 325272063 |

What is Routing Number?

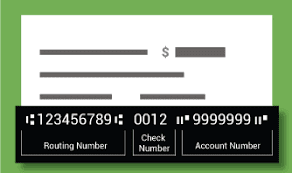

The nine-digit routing number is used to identify a bank. Consider it an electronic address that enables a bank to send and receive money from other financial institutions.

The routing number guarantees that money goes to the appropriate account and identifies the financial institution in charge of the payment.

The first two numbers are usually between 00 and 12. While major banks may have many routing numbers, smaller banks are only given one. Routing numbers are required to set up direct deposits with your company (for your paycheck) or the IRS, pay bills, order new checks, and pay bills (for a tax refund).

Credit Union 1 Routing Numbers for ACH Payments:

ACH routing numbers are used for electronic transfers and withdrawals.

You’ll need the ACH Routing Number when sending an ACH transfer to any Credit Union 1 account.

The Credit Union 1 Routing Number for ACH payment is 325272063.

| Type of Fund Transfer | CU 1 Routing Number |

|---|---|

| Domestic Electronic Transfer | 325272063 |

When Routing Number is Required?

You may easily carry out a range of banking operations if you understand what a routing number is and where to locate it.

Numerous routine financial operations involve routing numbers such as:

- Requesting your employer to set up direct deposit for your paycheck.

- Enabling direct deposit for government funds such as Social Security.

- Establishing an online bill payment schedule.

- Process checking.

- Transferring money by Fund Transfer or ACH Payment.

- Registering for peer-to-peer payment systems like PayPal or Venmo.

- Initiating transfers between your accounts at various banks.

- Making telephone payments from your bank account.

- Changing check orders.

How to Find CU 1 Routing Number?

There are different ways to trace the Credit Union 1 routing number:

1-Routing Number on Credit Union 1 Mobile App: The fastest and easiest way to find the Credit Union 1 Routing Number is to use Credit Union 1 Mobile App You can also find the routing number by following these directions:

- Login to your account and select the required account.

- Select the Account Information from the Account Options.

- Here you can find the last four digits of your account number which links to the full account number and the routing number.

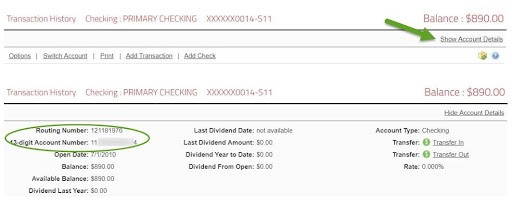

2-Credit Union 1 Routing Number via Online Banking:

- By entering into Credit Union 1 online banking and selecting the correct account, you can get your routing number there.

- The account title, the last four digits of your account number, and the CU1 Routing Number are all visible in the top box.

3-Credit Union 1 Routing Number on Monthly Statement:

- The top right corner of your monthly statement has your Credit Union 1 Routing Number.

- With e-statements, you can guarantee that your monthly statement is always available to you.

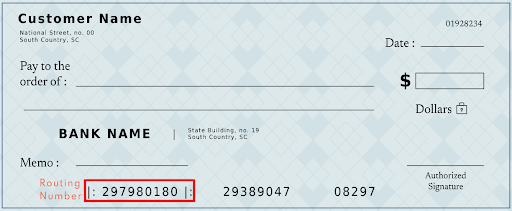

4-Credit Union 1 Routing Number on Check Book:

- The nine-digit number printed in the bottom left corner of every check is the CU 1 Routing Number.

5-On this page and on Website of Federal Reserve:

Credit Union 1 routing number for checking accounts and Fund transfers is listed on this page and on Website of The Federal Reserve.

Related Keywords:cu1 routing number , golden 1 routing number , credit union 1 anchorage routing number

Find Routing Number for Your Bank

We’ve mention here the routing numbers for some of the biggest banks in the US.

Frequently Asked Questions

No. The number on an ATM debit card is not a routing number. Debit cards and credit cards don’t use routing numbers. The financial institution links the ATM debit card to your bank account through its banking system.

No. All bank account holders with accounts set up in the same area have the same routing number. Routing numbers are readily available through online lookup tools. However, a bank account number should be considered confidential to avoid fraud resulting in the loss of funds. Treat a bank account number with the same degree of confidentiality as a Social Security Number.

No, your IBAN code and SWIFT code are different. Your IBAN identifies the individual bank account you’re using to make your overseas transfer, whereas your SWIFT is much shorter and used to identify a specific bank to verify international payments.

If you have a US bank account, you’ll need your routing number for every transfer and if it’s international, you’ll also need your SWIFT code.

- Business Planning

- Bank Business Plan

- Investor Business Plans

- Franchise Business Plan

- Strategic Business Plan

- M&A Business Plan

- Private Placement

- Feasibility Study

- Pitch Deck

- Pitch Deck

- Market Research

- Sample Business Plans

- Hire a Business Plan Writer

- Business Plan Printing

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Nonprofit Business Plan

- Business Plan Makeover

- Business Funding

- Business E-learning Series

- Business Assets

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

Quick Links

Business Planning

- Bank Business Plan

- Investor Business Plans

- Franchise Business Plan

- Strategic Business Plan

- M&A Business Plan

- Private Placement

- Feasibility Study

- Pitch Deck Business Plan

- Pitch Deck

- Market Research

- Sample Business Plans

- Hire a Business Plan Writer

- Business Plan Printing

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Nonprofit Business Plan

- Business Plan Makeover

Business Funding

Business E-learning Series

Business Assets

Business Building

Compliance

Immigration Business Plans

Business Partners

![How to Implement Security Measures That Actually Protect Your Business [Step-by-Step Guide]](https://wisebusinessplans.com/wp-content/uploads/2025/06/how-to-implement-security-measures-that-actually-protect-your-business-1024x576.webp)