How to Write a Check: A Step by Step Guide

Table of Contents

Digital banking is taking over but writing checks is still relevant. Writing a check is a safe way of sending money in the mail.

You may also need to learn ‘how to write a check’ for setting up direct debit instructions or connecting your bank account with some payment apps.

We have explained how to fill out a check. You can write a check easily.

Want to write a business plan?

Get help from our business plan writers now!

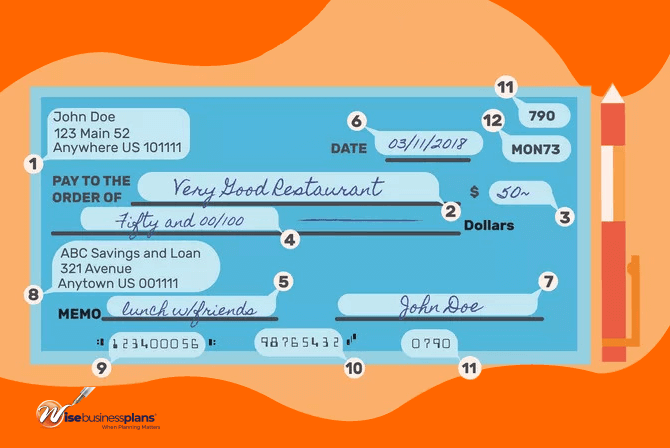

Parts of a check

A check has the following information on it.

- Personal information: details about the account owner, or the paying party

- Payee line: the receiver of the money

- Dollar box: Here goes the amount in numeric form

- Amount of your check: amount spelled-out in words

- Memo line: A short note on why you wrote the check

- Dateline: This is the timestamp for the check.

- Signature line: you approve the check by singing it here

- Your bank’s contact information and/or logo

- Your bank’s routing number

- Your account number

- The check number: It identifies each payment and helps prevent fraud.

- Your bank’s fractional ABA number

Access our free business plan examples now!

How to write a check?

Writing a check is easy, you just have to follow these simple steps:

1. Put the Date

Put the date in the upper right-hand corner. Mostly you’ll be putting today’s date.

2. Beneficiary or who is the check for

Write the name and details of the person you are writing the check to. See the ‘Pay to the Order of’ line on your check.

Sometimes, this person is also called a beneficiary.

3. The payment amount in numbers

There is a small box on the right side, use that box to write the amount in numbers. You don’t need to add your own dollar sign.

4. The payment amount in words

Spell out the amount in words. Make sure the amount in words is the same as the amount in numbers.

If the amount in words is different from the amount in numeric form, the spelled-out amount will legally be the amount of the check.

5. Write Memo

A memo is for your use. You can say why you wrote the check and it will help you remember details about it. The memo line is also helpful when you pay taxes to the IRS as you can write your SSN. Or you can use memo space for writing your utility bill number.

Ready to Open a Business Checking Account?

Compare 5 best online business bank accounts and find out which one is better for you.

Security Tips for Writing a Check

Following these simple security tips when writing a check will help you stay safe and avoid any scams.

Always Use a Pen

Make it permanent with a pen. If you use a pencil, anyone can erase and change the check which can cause financial loss to you. A ballpoint pen or a ballpen will also do the job.

Don’t Give a Blank Check

Don’t give a check unless it is filled in completely. If you are unsure about the price of something, take a check and a pen with you and fill in the check on the spot.

Keep Checks from Growing

Be cautious when putting in the amount in numeric form. Write the numeric amount on the left edge of the allocated space and draw a line after the last digit.

Adopt Consistent Signature Style

Keeping your signature style consistent helps fight fraud and scams. A banker can easily spot your signature when you have consistency.

If you don’t have a steady style, try practicing it. After some time, you will develop a flow and your signatures will start showing a pattern and consistency.

Write Fewer Checks

A check is a safe way to make payment, but so is online payment.

You may think you are avoiding technology but your check is converted into a digital asset when you submit it.

When you use online payment methods, you don’t need to keep a paper record. Everything is saved in an online record and it is searchable.

Want to write a business plan?

Get help from our business plan professionals now!

FAQs:

You can write a check to yourself. Put your name in the “Pay to the Order of” space. Sign the check, endorse it on the back of the check and present it to the teller or put it in the ATM.

Use the same process as above to fill out the check. However, you can also use your debit card or credit card to simply withdraw cash from any ATM or teller machine.

The best way to sign the check is when you have filled it in completely including the date, payee name, amount in numbers, and amount in words.

Sometimes, you may need to endorse the check on its back.

A cashier’s check is a safe way to make payments for large transactions like buying a house or a car.

You will need to go to your bank with some information including the exact amount, the beneficiary name, and your personal information.

Some banks and credit unions also offer cashier’s checks to non-customers also. You will need to pay for the amount to be transferred plus any fees.

The bank officer will take the necessary information from you and fill out the cashier’s check. You don’t have to fill it yourself.

First, understand that the amount you write in words is the legally-binding amount of the check. If it does not match with the numeric amount, the amount in words will hold up.

Let’s start with an example.

For example, we need to write a check for an amount of twelve hundred forty dollars and sixty-five cents. The numeric form of this amount is $1240.65.

You can write this amount of $1240.65 in words as under:

Twelve hundred forty and 65/100

You don’t need to write ‘dollars’ at the end; the check already mentions the word.

However, if the check does not mention the word ‘dollars’ at the end of the amount line, write the word ‘dollars’ at the end of your amount in words.

When you are writing a check with an amount in thousands, match the numeric and the word amount on the check.

For example, if you want to write a check for $1000, write “1000.00” in the numeric amount box. Draw a straight line if there is still space in the numeric amount box.

For a check of $1000, you can write the amount in words like this.

One thousand and 00/100

You don’t need to write the word ‘dollars’ as it is pre-written on the check.

Writing numbers in words on a check is very easy.

For example, if you want to write $1000 in words, write “one thousand and 00/100”. Draw a line on the remaining space.

- Put the date

- Add payee name in “Pay to the order of”

- Put the amount in numeric form in the relevant box as ‘$1200.00’

- Put the amount in words in the amount field as ‘one thousand two hundred and 00/100’

- Add a memo to remember what the check was about

- Sign the check

- Put the date

- Add payee name in “Pay to the order of”

- Put the amount in numeric form in the relevant box as ‘$1200.00’

- Put the amount in words in the amount field as ‘one thousand two hundred and 00/100’

- Add a memo to remember what the check was about

- Sign the check

The process of writing a check for the Bank of America is no different from writing a check for any other bank. Please follow the process explained at the start for writing a check Bank of America.

Related Resources: Parts of a Check