What are Net 30 Payment Terms? Should You Use Them?

Table of Contents

- What are Net 30 Payment Terms? Should You Use Them?

- What is net 30?

- What does net 30 mean on an invoice?

- How do net 30 payment terms work?

- When exactly does net 30 start?

- Net 30 discounts can also be indicated

- Do you know what ‘3/10 net 30’ means?

- What does “2/10 net 30” mean?

- What are the benefits of using net 30?

- Risks associated with offering net 30 terms

- Why do clients like net 30 accounts?

- What are the alternatives to net 30 terms?

- How do I decide if net 30 payment terms are right for my business?

- How do I get started with a net 30?

- FAQs:

What are Net 30 Payment Terms? Should You Use Them?

One critical step you should take before signing the contract, delivering the work, and sending an invoice to your customer is to figure out your payment terms. Many businesses across the country use net 30 invoice terms.

However, what does net 30 mean, how does it work, and are there any alternatives? This comprehensive guide has all the information you need.

What is net 30?

Net 30 is one of the most common credit terms used when extending credit to consumers. When you offer someone net 30 terms, you’re giving them the option to pay you for a good or service up to 30 calendar days after billing them.

Net 30 is a type of trade credit. Basically, when you agree to net 30 terms, you are issuing a short-term business loan to your clients, much like a bank or credit card company does when consumers make purchases using their credit cards.

Hire our business plan consultants now!

What does net 30 mean on an invoice?

Net 30 is a payment term included in an invoice. It specifies when the vendor wants to be paid for the product or service they provided. In this case, net 30 means the vendor wants to be paid within 30 days from the invoice date.

The U.K. also uses the term “net 30” for invoicing. It means the invoice is due at the end of the month following the month of the invoice. In other words, if you receive an invoice in December, you’ll need to pay it by the end of January.

Although 30 days is a common time frame, it is not the only one:

- There are also common time frames of 10, 20 and 60 days. On an invoice, these could also be written as Net 10, Net 20 and Net 60, respectively.

- You can add other payment terms. As an example, Net 30 EOM means that the payment must be received by the 30th day of the following month. If the invoice is dated Oct. 15, then the payment is due Nov. 30.

- Businesses might change the timeline from customer to customer. Trusted customers with a record of on-time or early payment might receive a longer time frame as a courtesy or perk.

- There is no need to use this shorthand. An alternative is to write the exact date the payment is due, or you can use a phrase such as “due within 30 days from the invoice date”

Related: What Does Net 30 Mean on an Invoice?

How do net 30 payment terms work?

Simply add “net 30” to the payment terms of your invoice and you’re good to go. Once the goods/services are delivered to your customer, send an invoice.

While it’s important to remember that late payments are an issue many small-to-medium-sized businesses (SMBs) face on a daily basis, you should be reimbursed within the agreed-upon 30-day period.

Net 30 is frequently used in conjunction with a discount for early payment, but it can also be used without a discount. Let’s say you want to give a 2% discount on invoices that are paid within 10 days. It will be written as 2/10 Net 30.2

When exactly does net 30 start?

Depending on what you and your client have agreed to, the due date in net 30 terms can differ.

The “30” in net 30 could mean 30 days after the sale, 30 days after the goods are delivered to the client’s door, 30 days after the website you designed for them goes live, 30 days after the invoice date, or any other date. It really depends on your business and how generous you are with your clients.

Whichever date you choose, be sure to spell it out in your contracts in clear language.

Net 30 always includes calendar days (such as weekends, holidays, and business days). Make sure that is clearly stated in the contract you sign with your client.

Net 30 discounts can also be indicated

Many companies wish to offer flexible payment terms to their customers, but they also want to encourage prompt payment. To do this, they’ll offer a reduced rate if the full amount is paid before a specific date. If they pay after the discount term, they’re responsible for the net amount.

For example, the company may be willing to wait 30 days for the payment but will provide a discount if it’s paid within the first week. Therefore, the invoice or contract would say “5/7 net 30.”

In the same way, you can create your own terms. You may simply write them as (percentage discount) / (number of days in the discount period) net (number of days to make the entire payment).

Do you know what ‘3/10 net 30’ means?

Net 30 invoice terms are sometimes combined with a discount. In order to encourage customers to pay more quickly, a discount is offered. Therefore, when you see an invoice that states ‘3/10’, it means that customers can receive a 3% discount if they pay within 10 days.

What does “2/10 net 30” mean?

Net 30 terms are often accompanied by a discount for early payment to motivate clients to pay more quickly. Small business owners often offer net 30 terms with a 2 percent discount if the client pays in full within 10 days. Contracts and invoices will list these terms as “2/10 net 30.”.

You can also change it up to whatever you like. As an example, if you offered your client net 60 terms with a 5 percent discount if they paid within 15 days, you would write it as “5/15 net 60.”

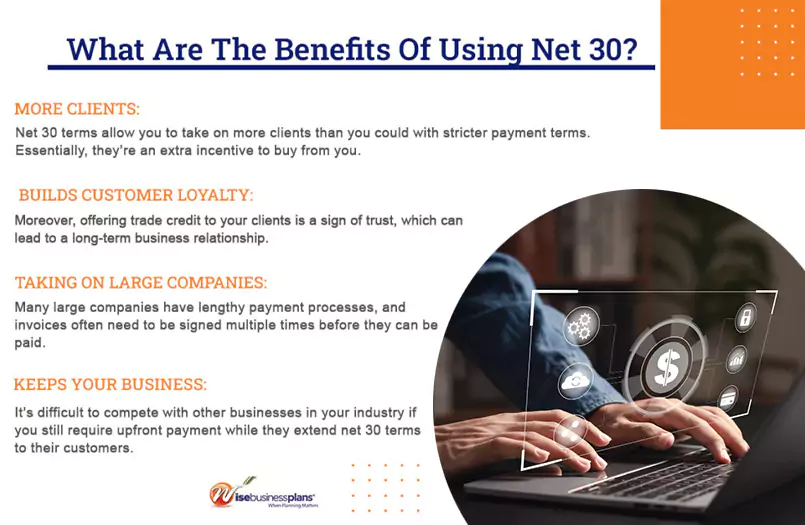

What are the benefits of using net 30?

Having net terms can give your business an edge over your competitors. According to Wise Business Plans, a company that offers net 30 terms, they saw a 30% increase in sales when they started offering net terms.

Payment terms with a net 30 can be useful for a variety of reasons.

- More Clients: Net 30 terms allow you to take on more clients than you could with stricter payment terms. Essentially, they’re an extra incentive to buy from you.

- Builds customer loyalty: Moreover, offering trade credit to your clients is a sign of trust, which can lead to a long-term business relationship.

- Taking on large companies: Many large companies have lengthy payment processes, and invoices often need to be signed multiple times before they can be paid. Others only send payments once a week, biweekly, or even monthly. It’s likely you’ll have to relax your terms if you want to work with a large company.

- Keeps your business competitive: It’s difficult to compete with other businesses in your industry if you still require upfront payment while they extend net 30 terms to their customers. Not all businesses are able to extend credit to all of their customers, however doing so can help you remain competitive.

Risks associated with offering net 30 terms

While many small business owners don’t realize it, accepting payment after a service is performed or goods are delivered is extending credit. Therefore, it has the same drawbacks as a business loan.

- Slow Cash Flow: Extending credit can lead to cash flow problems. Many small businesses require faster payments to remain in business.

- Late payments: Even if you offer discounts for early payments and charge late fees, your customers may still pay after the due date.

- Fraud: You might even be defrauded by people who never intended to pay in full. A study by the Association of Certified Fraud Examiners found that U.S. businesses lose 5% of sales to fraud.

- Cost of opportunity: As long as your cash is tied up with the credit you’ve extended, you may not be able to purchase supplies or other goods and services your business needs to grow. You might also miss out on discounts from your own suppliers as a buyer.

Access our free sample business plans now!

Why do clients like net 30 accounts?

New businesses establish net 30 accounts with their vendors in order to build their business credit beyond the obvious advantage (more time to pay their invoices). These “small vendor lines of credit” can help new businesses build their credit score and access additional capital.

This strategy, however, only works if vendors report their accounts to business credit bureaus such as Dun & Bradstreet (D&B), Experian Business, or Equifax Business-and vendors aren’t required to do so.

Recommended: Check out these 10 Net-30 Vendors to help You build business credit

What are the alternatives to net 30 terms?

Many smaller businesses choose not to offer net 30 terms because they find it too long to wait to get paid. Generally, net 7 or net 15 is a better option for enforced payments. Alternatively, if you’re willing to offer more generous terms to your clients, you might consider offering net 60 or net 90 terms.

Recommended: What are Net 30/60/90 Terms?

How do I decide if net 30 payment terms are right for my business?

This depends on how much cash you have on hand, how many clients you have, whether it’s common in your industry, and most importantly, how generous you can afford to be with your clients.

Net 30 might help you gain more clients if you have plenty of cash on hand, have many clients, and can survive a few late payments from them.

In contrast, if you only have a few clients and don’t have a lot of cash on hand, offering them net 30 terms on their payments could cause you problems with cash flow.

It can help to think like a lender when you’re dealing with situations like this since extending your credit terms or offering longer payment terms is similar to increasing your clients’ credit limits. Is their payment history sufficient to justify more generous terms?

If your business is still in the early stages and you haven’t developed a reliable cash flow rhythm, consider asking for upfront deposits on large orders and adding interest to the contracts you have clients sign. Consider requesting a business credit check on new clients before issuing trade credit if you want to minimize risk even further.

If a new client sees these terms, they will understand you’re serious about getting paid on time. No one wants to pay late fees.

How do I get started with a net 30?

All you need to do is write net 30 into your contracts and clearly explain it to your next client before you begin the project. If they agree to it and sign the contract, you’re officially on net 30!

Want to write a business proposal?

Hire business proposal writers now!

FAQs:

Net 10 means that the full amount is due within 10 days of the invoice date, at the latest. Net 10 is a credit term that means services and products are sold in advance and the client pays later.

If a small business has new customers or customers who tend to pay late, it may use shorter payment terms, like net 10. Once the customer pays on time, the business may extend longer payment terms like net 30 or net 60.

Instead of writing “net 30,” you might say “payment is due within 30 days.” This makes things even more clear to the customer. You should always be as clear and concise as possible with your terms of payment, and try to maintain consistency from invoice to invoice

Generally, net 15 means that payment is due within 15 days of the invoice date, at the very latest.

Net 15 is fairly short. Small businesses may use these terms to deal with new clients or clients who haven’t paid their invoices on time in the past.

Net 30 end of the month (EOM) means that the invoice payment is due 30 days after the end of the month in which the invoice was sent. If you and your client agree to net 30 EOM and you invoice them on May 11th, the payment will be due June 30th-or 30 days after May 31st.

Not at all. Whether a business uses net 30 terms depends on the type of business it operates. Retail businesses rarely extend credit to customers. If you want to buy an espresso from your local café, you usually need to pay on the spot.

Much smaller, non-retail businesses will also avoid net 30 since 30 days is simply too long for them to wait to be paid. They may offer less generous payment terms, such as net 14, or they might not offer trade credit at all.

Although it’s most common in the world of big business, it’s also common in consulting, graphic design, software development, and other service industries.

![How to Implement Security Measures That Actually Protect Your Business [Step-by-Step Guide]](https://wisebusinessplans.com/wp-content/uploads/2025/06/how-to-implement-security-measures-that-actually-protect-your-business-1024x576.webp)