A routing number is an important element in the banking system that allows seamless money transfers between banks. Whether you want to set up direct deposit, send wire transfers, or pay bills online, understanding routing numbers is crucial. In this article, we will explain what routing numbers are and provide easy-to-understand examples to help you grasp this banking term.

What Is A Routing Number ?

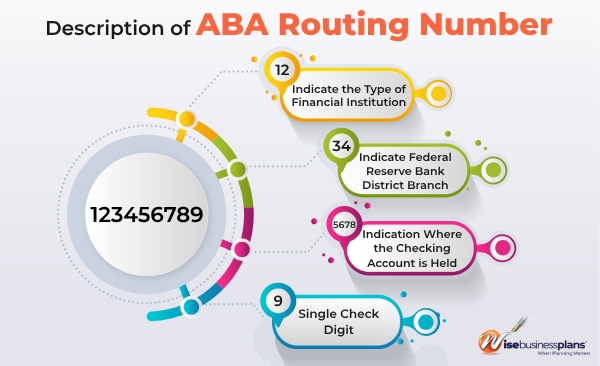

A routing number, also known as an ABA (American Bankers Association) number, is a unique code consisting of nine digits. It helps identify the bank or credit union involved in a transaction and guides the funds to the correct destination. Think of it as an address for your money.

For Example: Let’s take an example of a routing number to understand its structure and significance. Consider the routing number 123456789. In this example, the first two digits, “12,” indicate the Federal Reserve Bank’s location. The next four digits, “3456,” represent the specific bank or credit union. The final three digits, “789,” act as a check digit to ensure the accuracy of the routing number.

How Does a Routing Number Look?

How Does a Routing Number Look? A routing number is made up of three parts: the Federal Reserve routing symbol, the ABA institution identifier, and the check digit. The routing symbol represents the region where the bank is located, the institution identifier identifies the specific bank, and the check digit ensures the accuracy of the routing number.

Types of Transactions That Require Routing Numbers

Routing numbers are required for various types of financial transactions, including:

Direct Deposit: When you receive your salary, government benefits, or other regular payments directly into your bank account, the routing number is necessary. It ensures that the funds are correctly routed to your account.

ACH Transfers: Automated Clearing House (ACH) transfers are electronic payments made between banks. Whether it’s paying bills online or transferring funds between accounts, the routing number is essential for ACH transactions.

Wire Transfers: Wire transfers involve the immediate transfer of funds from one bank to another. Routing numbers are crucial in wire transfers to identify the receiving bank and ensure the successful transfer of money.

Online Bill Payments: When you pay bills online, such as utility bills, credit card payments, or mortgage payments, the routing number is required to direct the payment to the appropriate financial institution.

Setting Up Automatic Payments: If you want to set up automatic payments for recurring bills, such as monthly subscriptions or loan repayments, the routing number is needed to ensure the payments are correctly processed.

Sending and Receiving Money Between Banks: When you send money to someone’s bank account or receive money from another bank account, the routing number is necessary to facilitate the transaction securely and accurately.

ACH Debits and Credits: ACH debits are used to withdraw funds from your account, while ACH credits are used to deposit funds into your account. Routing numbers play a vital role in both types of transactions.

Mobile Check Deposits: When you deposit a check using a mobile banking app, the routing number is required to identify the issuing bank and process the deposit.

How can I locate the routing number on a check?

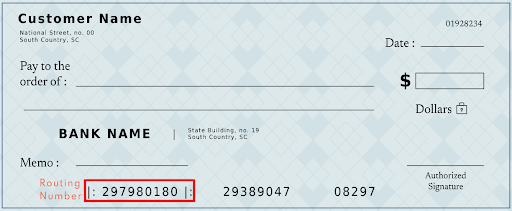

To find the routing number on a check, you can follow these steps:

1. Look at the bottom left corner of the check. You will see a series of numbers printed there.

2. The routing number is typically the first nine-digit number in the series. It is usually printed in a different font and is followed by a colon or a symbol.

3. Sometimes, the routing number is also referred to as the ABA routing number or the transit number.

Where can I find the routing number without a check?

There are different ways to trace the routing number without a check:

1-Routing Number on US Bank Mobile App: The fastest and easiest way to find the routing number is to use US Bank Mobile App You can also find the routing number by following these directions:

- Login to your account and select the required account.

- Select the Account Information from the Account Options.

- Here you can find the last four digits of your account number which links to the full account number and the routing number.

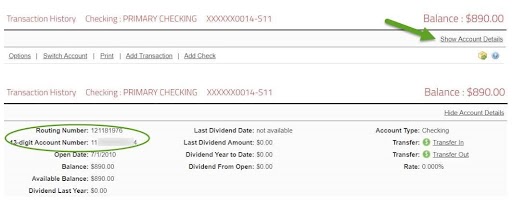

2-Routing Number via Online Banking:

- By entering into online banking and selecting the correct account, you can get your routing number there.

- The account title, the last four digits of your account number, and the routing number are all visible in the top box.

- Simply choose the link for the final four numbers if you also require the whole account number.

3-Routing Number on Monthly Statement:

- The top right corner of your monthly statement has your routing number.

- With e-statements, you can guarantee that your monthly statement is always available to you.

4-Routing Number on US Bank Routing Number Directory:

- Numerous routing numbers belonging to U.S.

- Bank identify the various areas in which we conduct business.

- The region in which you opened your account will be represented by your routing number.

Routing Number vs. Account Number: What's the Difference?

Routing numbers and account numbers are both important elements in banking, but they serve different purposes. Here’s a breakdown of the difference between routing numbers and account numbers:

Routing Number:

A unique nine-digit code.

Identifies the bank or credit union.

Helps route funds accurately during transactions.

Required for various transactions like direct deposits, bill payments, wire transfers, and ACH transfers.

Public information is easily found on checks, bank statements, and online banking platforms.

Example: 021000021 (Bank of America)

Account Number:

A unique identifier

Identifies the individual account

Used to access and manage funds within the account

Used for account-specific activities like withdrawals, deposits, and transfers

Confidential information should be kept secure

Example: 123456789

Routing Number Example:

Let’s say you want to set up direct deposit for your salary. Your employer requires you to provide the routing number for your bank. For instance, if your bank is Wells Fargo, the routing number for Wells Fargo is 121000248. This routing number identifies Wells Fargo as the financial institution where your account is held. It ensures that your salary is routed correctly to your Wells Fargo accou

Account Number Example:

Now, let’s focus on the account number. Suppose you have an individual checking account at Wells Fargo, and the account number associated with your account is 123456789. This account number is unique to you and distinguishes your specific checking account from other accounts held at Wells Fargo. It is confidential information and should be safeguarded to prevent unauthorized access to your funds.

A routing number typically consists of 9 digits. For example, a routing number could be 123456789.

An ABA routing number, also known as an American Bankers Association routing number, is a unique identification number assigned to banks and financial institutions in the United States. It is used for the purpose of identifying the financial institution in electronic transactions, such as direct deposits, wire transfers, and electronic payments. The ABA routing number is a nine-digit number and is typically located at the bottom left corner of a personal check.

No, credit cards do not have routing numbers. Routing numbers are specific to bank accounts and are used for identifying the financial institution where the account is held. Credit cards, on the other hand, are issued by credit card companies and are not associated with bank accounts in the same way. Credit card transactions are typically processed using the credit card number, expiration date, and CVV code, rather than a routing number.

No, a routing number is not the same as a checking or savings account number.

A routing number is a nine-digit number used to identify the financial institution where an account is held. It is used for various electronic transactions, such as direct deposits, wire transfers, and electronic payments.

On the other hand, a checking or savings account number is a unique number assigned to an individual account within a specific financial institution. It is used to identify and distinguish individual accounts for depositing, withdrawing, or transferring funds.

While the routing number is used to identify the bank or credit union, the account number is used to identify the specific checking or savings account within that institution.

Yes, Cash App does provide users with a routing number. Cash App, a peer-to-peer payment service, offers a feature called Cash App Direct Deposit. This feature allows users to receive direct deposits into their Cash App account, and as a part of that service, Cash App provides users with a routing number and an account number. The routing number provided by Cash App allows users to set up direct deposit with employers or other institutions that require routing and account numbers for electronic transfers.

- Business Planning

- Bank Business Plan

- Investor Business Plans

- Franchise Business Plan

- Strategic Business Plan

- M&A Business Plan

- Private Placement

- Feasibility Study

- Pitch Deck

- Pitch Deck

- Market Research

- Sample Business Plans

- Hire a Business Plan Writer

- Business Plan Printing

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Nonprofit Business Plan

- Business Plan Makeover

- Business Funding

- Business E-learning Series

- Business Assets

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

Quick Links

Business Planning

- Bank Business Plan

- Investor Business Plans

- Franchise Business Plan

- Strategic Business Plan

- M&A Business Plan

- Private Placement

- Feasibility Study

- Pitch Deck Business Plan

- Pitch Deck

- Market Research

- Sample Business Plans

- Hire a Business Plan Writer

- Business Plan Printing

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Nonprofit Business Plan

- Business Plan Makeover

Business Funding

Business E-learning Series

Business Assets

Business Building

Compliance

Immigration Business Plans

Business Partners